What Happens to Life Insurance with No Beneficiary?

Life insurance provides a safety net for your loved ones in the event of your passing. Typically, policyholders designate beneficiaries who will receive the life insurance payout. However, situations can arise where no beneficiary is named, or the named beneficiaries are no longer alive. What happens to life insurance with no beneficiary? Understanding what happens in these scenarios is essential for ensuring your policy benefits are distributed as intended.

The Role of Beneficiaries

A beneficiary is a person or entity designated by the policyholder to receive the death benefit from a life insurance policy. This can be a spouse, child, relative, friend, or even a trust or charity. Naming beneficiaries ensures that the policy proceeds are distributed according to the policyholder’s wishes.

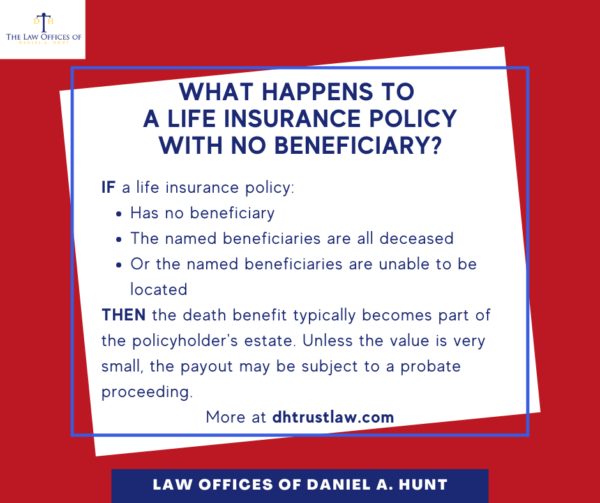

What Happens When There’s No Beneficiary?

If there are multiple “co-beneficiaries” on a policy and one of them has passed away, the death benefit is typically distributed to the remaining co-beneficiaries. But when no beneficiary is named on a life insurance policy, or the named beneficiaries are all deceased or unable to be located, the death benefit typically becomes part of the policyholder’s estate.

This means the policy proceeds are subject to the California probate process, which is public, time-consuming, and costly. During probate, the court oversees the distribution of the estate according to the decedent’s will or, if there is no will, according to state intestacy laws.

If the deceased didn’t create a will and the death benefit is subject to California intestacy laws, the distribution follows a predetermined hierarchy of relatives. Typically, the order starts with the spouse if they were married, followed by children, parents, siblings, and grandparents. In rare cases when the decedent lacks any living relatives, the property will escheat to the State of California.

Note that intestacy laws may not align with the policyholder’s intentions while they were alive. This demonstrates the importance of naming beneficiaries on all assets.

Are There Any Exceptions?

While life insurance policies without a beneficiary are generally subject to probate, an exception may exist based on the life insurance company’s policies. Some life insurance companies have policies that dictate who receives the policy proceeds in such situations.

Another exception could occur if the life insurance benefit is small enough to fall under the current California probate threshold, which is $184,500 in 2024. If the policy payout value is less than this amount, the decedent’s family members may be able to use a small estate affidavit to claim the life insurance payout instead of undergoing a full probate proceeding.

Steps to Avoid Issues with No Beneficiary

If you’re wondering how to avoid a situation where a life insurance policy triggers a probate, here are a few tips.

- Regularly Review and Update Beneficiaries: Life circumstances change, whether it be through marriages, divorces, births, or deaths. Regularly reviewing and updating your beneficiary designations ensures that the policy benefits go to the intended recipients.

- Designate Contingent Beneficiaries: Naming contingent (or secondary) beneficiaries provides a backup in case the primary beneficiary dies before the policyholder or cannot be located. This helps ensure the death benefit does not default to the estate.

- Consider a Life Insurance Trust: Establishing an Irrevocable Life Insurance Trust (or ILIT) can be an effective way to manage life insurance proceeds, especially for larger policies or complex family situations. A trust can provide detailed instructions on how the proceeds should be used, protecting the assets from creditors and ensuring privacy.

- Communicate Your Wishes: Clearly communicate your intentions to your loved ones and legal advisors. Ensure that your life insurance policy and all estate planning documents are consistent and reflect your current wishes.

By keeping beneficiary designations up to date, you can ensure that your loved ones are provided for according to your wishes. Regularly reviewing and updating your policy is a small but significant step in your estate planning. By doing so, you can have peace of mind knowing that your life insurance will effectively serve its purpose.

If you have any questions about what happens to life insurance with no beneficiary, feel free to reach out to our law firm.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.